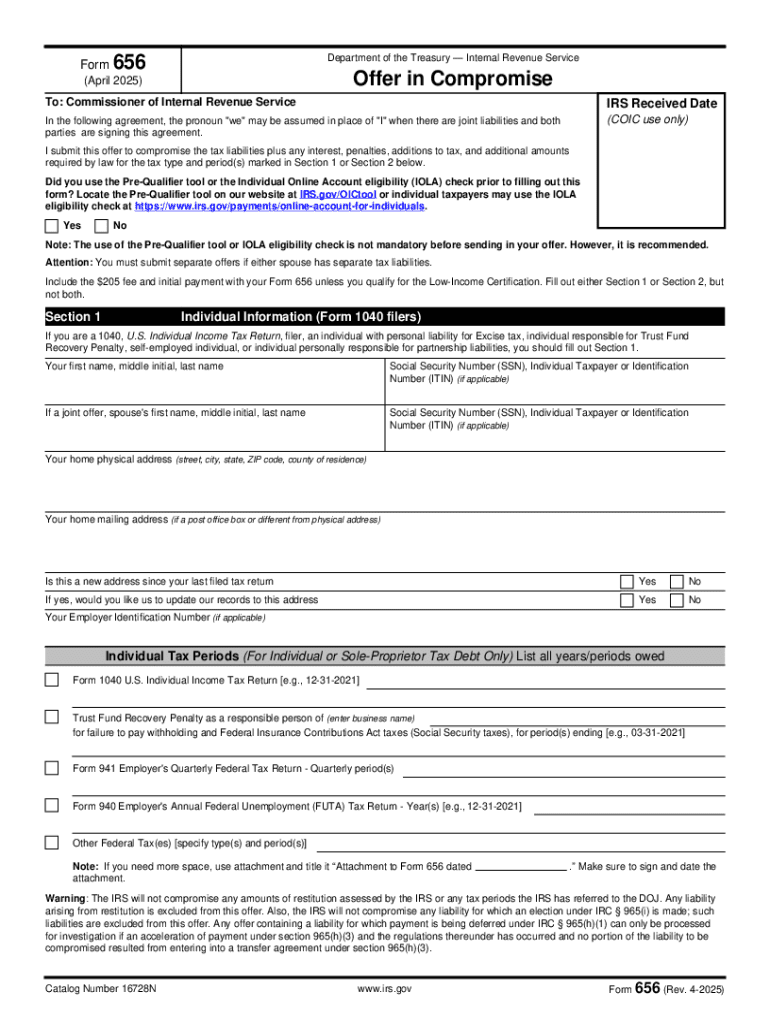

IRS 656 2025-2026 free printable template

Instructions and Help about IRS 656

How to edit IRS 656

How to fill out IRS 656

Latest updates to IRS 656

All You Need to Know About IRS 656

What is IRS 656?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 656

What should I do if I made a mistake after submitting IRS 656?

If you discover an error after submitting IRS 656, you can file an amended form to correct the mistake. Be sure to indicate that it is a corrected submission clearly. You may also want to keep records of your original and amended submissions for your files, as they could be needed for future reference.

How can I track the status of my IRS 656 submission?

To track the status of your IRS 656 submission, you can use the IRS's online tools. You'll typically need your identifying information and submission details. Regularly checking the status will help you confirm if the IRS has received and processed your form without any issues.

What common errors should I avoid when submitting IRS 656?

Common errors when submitting IRS 656 include incorrect taxpayer identification numbers and omissions of necessary signatures. Double-check all entered information and ensure you've followed any specific instructions provided for the form to minimize rejection risks.

Are electronic signatures accepted for IRS 656?

Yes, electronic signatures are accepted for IRS 656 under specific conditions. Ensure you follow the IRS guidelines for e-signatures and maintain documentation as needed to comply with legal standards for authenticity.